Oops! We Lost This Page

But you don’t have to miss out.

Sometimes links break or pages wander off. While you’re here, why not stay connected? We share helpful updates, resources, and news.

Get Helpful Updates Straight to Your Inbox

Be the first to hear about fresh content and announcements.

About

Books

Coaching

Scale Faster & Predictably (With More Time Freedom)

Install the proven growth-oriented 2X Operating System to create a thriving 7/8-figure business (that isn’t so reliant on you!)

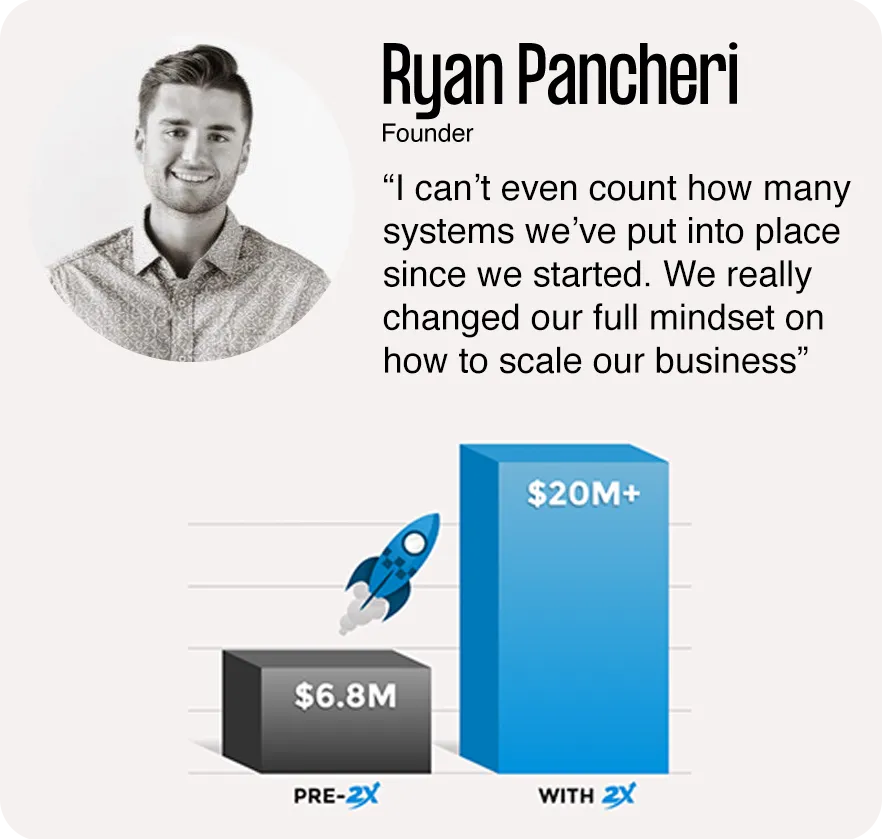

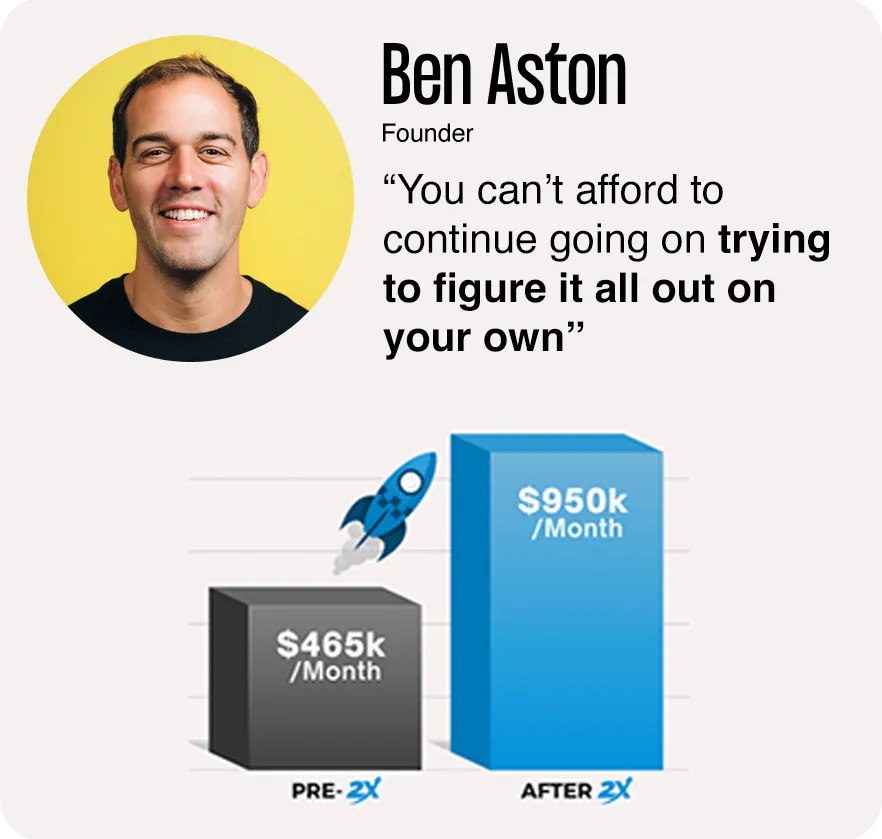

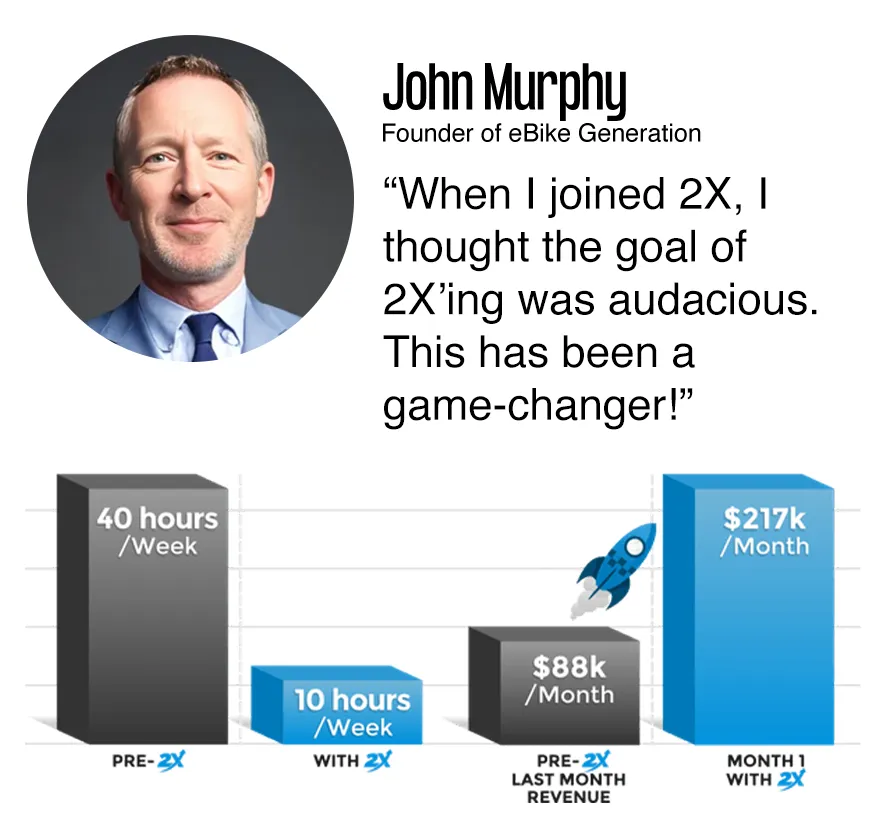

Over $513M+ In Client Growth

We have the proven process and systems we’ve optimized for years to help you get free and grow to multiple 7-figures (and beyond).

Scale Faster & Smarter

You can in fact have a wildly successful 8-figure business that scales consistently without being stuck “in” the business. We’ll show you how.

Complete The Business Growth Assessment

Build the structure, team, and accountability to scale from six to seven figures, without burning out or getting stuck in operations.

Get A Custom Growth Plan

Build the structure, team, and accountability to scale from six to seven figures, without burning out or getting stuck in operations.

Scale With Consistency

& Control

Build the structure, team, and accountability to scale from six to seven figures, without burning out or getting stuck in operations.

© 2025 2X | Systemize & Scale, LLC

Disclaimer: Fast growth and big success are not easy. We help entrepreneurs 1-on-1 to implement strategies based on our experience and expertise. Each business is different, which means that every situation is different, and your results will vary.